Restaurants

Restaurants typically achieve the following Specialized Tax Incentives and Corporate Expense Reduction averages:

Property Owner Tax Incentives -- $230,000

Credit Card Processing -- 21%

Credit Card Processing -- 21%

Waste & Recycling Savings -- 27%

Work Comp Insurance Savings -- 15%

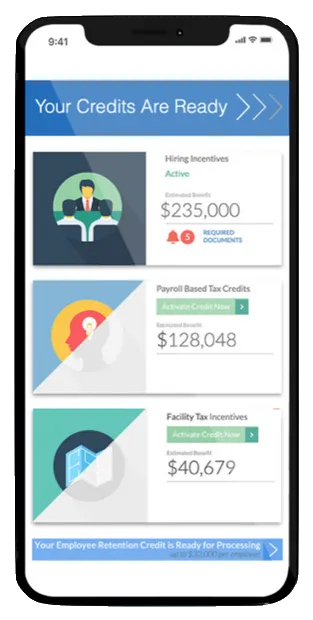

Claim Restaurant Tax Credits with the Tax Incentive Management System

The Tax Management System (TMS) allows restaurants to track and claim all of their available tax credits. Designed to increase your cashflow, automate your HR platform and continuously check for tax credits.

Tax Credits Restaurants Are Eligible For

Commercial Property Incentives

Cost Segregation is a powerful tax strategy designed to accelerate depreciation on buildings, creating significant tax savings. Owners can increase cash flow and reduce taxes by thousands – often recovering 20-30% of the building’s cost.

Worker Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to restaurant employers who hire and employ individuals from specific target groups. An employer will average a benefit of $2,400 per eligible employee.

Research & Development Tax Credit

The R&D Tax credit is for taxpayers that design, develop, or improve products, processes, techniques, formulas, or software. Most businesses now perform some level of internal "R&D" and can be eligible for this annual tax credit.

Your One System To Do It All

Check Your Tax Credits

The Tax Management System is designed to easily check your tax credits instantly in any quarter of the tax season for your business.

Manage Your HR Platform

Designed to manage all of your Human Resources communications and admin responsibilities all within one platform.

Continuous Support

Our team of specialized tax professionals are designated to support you and any of your tax credit or HR needs in the TMS system.

Increase Cash Flow

Let the experts do what we do best, we are best at increasing your cash flow and letting you run your business

Restaurant Tax Credits Made Easy

Want to learn how your restaurant can adapt to rising operational costs and irregular cash flows?

CLICK BELOW TO WATCH FIRST!

Every Commercial Property Owner Should Utilize Cost Segregation

Step 1: Upload Your Payroll Reports

This is the only step you need to do, We will take care of the rest. Simply answer a few questions and submit your quarterly payroll reports using a secure online submission form.

Step 2: We Calculate, You Claim

Our team will examine your submission and calculate your credit, providing you with a claim report that your CPA will file with your tax return to claim your credit.

Step 3: Earn Tax Credits Continuously

This is just the beginning. The TMS will continue to search for all available tax credits and incentives for your restaurant on an ongoing basis. Let us find you every penny you're entitled to!

We Make Claiming Tax Credits Easy For Restaurants

Understanding tax credit eligibility can feel overwhelming and confusing, especially for businesses that are in the hospitality industry. More often than not, day-to-day operations are time-consuming and take precedence over everything else. In addition, the industry was (and continues to be) the hardest hit by COVID-19, which is why there has never been a more critical time for restaurants and other hospitality business owners to determine which tax credits they are eligible to receive—the potential benefit is too great to pass up.

Get started with an established industry leader and claim your funds now.

By leveraging government tax credits, businesses can continue expanding operations and accelerating their industry presence. As an industry leader for over twenty-three years, we have identified over $37B in incentives for our clients. Let our expertise work for you. Our team of professionals will Sub-Headlinenavigate the process for you and get your tax credits immediately.